Access our exclusive channel to receive special content.

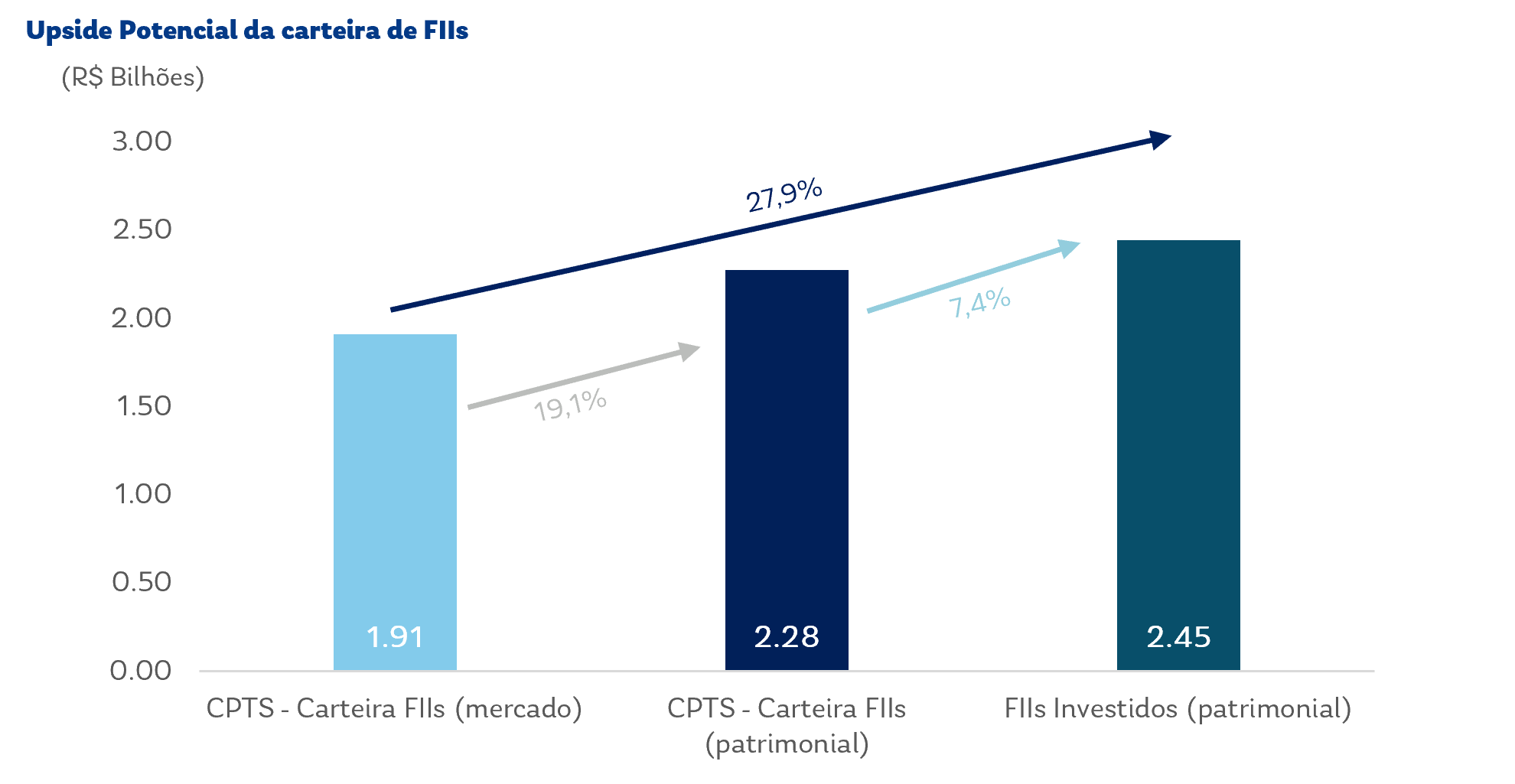

The charts below have been updated with the reference date of 31/12/2025

| Name | Capitânia Securities II FII Responsabilidade Limitada |

| CNPJ | 18.979.895/0001-13 |

| Fund Inception Date | 05/08/2014 |

| BOVESPA Ticker | CPTS11 |

| Manager | Capitânia S/A |

| Administrator | BTG Pactual Serviços Financeiros S/A DTVM |

| ANBIMA Classification | FII TVM Renda Gestão Ativa – Títulos e Valores Mobiliários |

| Investor Profile | General Investor |

| Administration and Management Fee | 0.90% p.a. |

| Performance Fee | 15% of the dividend distributed over the net asset value that exceeds the CDI |

Performance Chart

Monthly Dividend Distribution

Distribution History

Monthly Trading Volume in the Secondary Market (12M)

The FUND’s Investment Policy is to acquire the TARGET ASSETS, and it may allocate up to 100% of its net assets to CRIs (Real Estate Receivables Certificates), FII quotas (Real Estate Investment Funds), FIDC quotas (Receivables Investment Funds), Debentures, LH (Mortgage Bills), LCI (Real Estate Credit Bills), LIG (Covered Bonds), and other securities, provided the issuers are registered with the CVM and their main activities are permitted for real estate investment funds. The FUND may also allocate up to 20% to real estate stocks and FIA quotas (Equity Investment Funds). For real estate properties, FIP quotas (Private Equity Investment Funds), and equity interests, the allocation limit varies according to the fund’s NAV: up to 50% for NAV up to R$500,000,000.00, up to 40% for NAV between R$500,000,000.01 and R$1,000,000,000.00, and up to 30% for NAV above R$1,000,000,000.00.

Capitânia Securities II FII (ticker CPTS11) – A Real Estate Investment Fund established as a closed-end fund with an indefinite term, traded on B3. The fund aims to generate returns for its shareholders through the acquisition of real estate-related assets.